The 6-Second Trick For Tulsa Bankruptcy Legal Services

The 6-Second Trick For Tulsa Bankruptcy Legal Services

Blog Article

All about Chapter 7 - Bankruptcy Basics

Table of Contents3 Simple Techniques For Top-rated Bankruptcy Attorney Tulsa OkTop-rated Bankruptcy Attorney Tulsa Ok Can Be Fun For Anyone9 Simple Techniques For Bankruptcy Attorney Near Me TulsaThe 6-Second Trick For Best Bankruptcy Attorney TulsaAll about Which Type Of Bankruptcy Should You FileMore About Chapter 7 - Bankruptcy Basics

People must use Phase 11 when their debts surpass Chapter 13 debt limitations. It seldom makes sense in other circumstances however has a lot more alternatives for lien stripping and cramdowns on unsafe sections of protected finances. Chapter 12 insolvency is created for farmers and anglers. Phase 12 settlement plans can be extra flexible in Phase 13.The means examination considers your ordinary month-to-month income for the 6 months preceding your filing day and compares it versus the typical income for a similar house in your state. If your revenue is below the state average, you automatically pass and do not need to complete the entire type.

If you are married, you can file for bankruptcy collectively with your partner or separately.

Filing insolvency can assist a person by disposing of financial debt or making a strategy to settle financial obligations. An insolvency instance typically begins when the borrower files an application with the bankruptcy court. There are various kinds of bankruptcies, which are usually referred to by their chapter in the U.S. Bankruptcy Code.

If you are facing monetary difficulties in your individual life or in your company, opportunities are the idea of declaring bankruptcy has crossed your mind. If it has, it likewise makes feeling that you have a lot of bankruptcy concerns that need answers. Many individuals really can not address the question "what is insolvency" in anything other than basic terms.

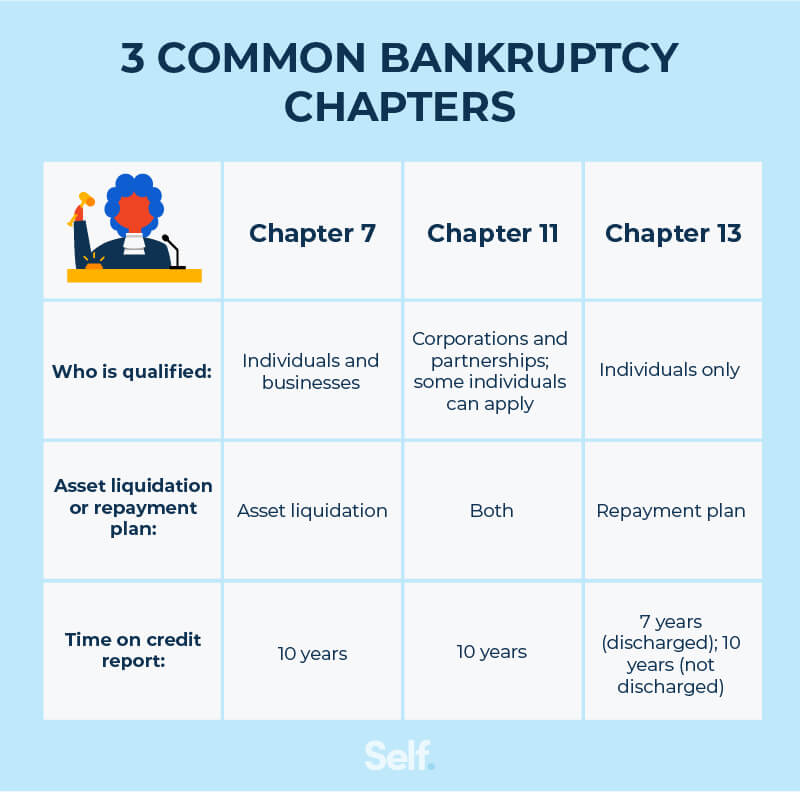

If you are facing monetary difficulties in your individual life or in your company, opportunities are the idea of declaring bankruptcy has crossed your mind. If it has, it likewise makes feeling that you have a lot of bankruptcy concerns that need answers. Many individuals really can not address the question "what is insolvency" in anything other than basic terms.Lots of people do not understand that there are numerous kinds of insolvency, such as Phase 7, Phase 11 and Phase 13. Each has its benefits and obstacles, so recognizing which is the most effective choice for your existing situation along with your future recuperation can make all the distinction in your life.

Some Known Factual Statements About Tulsa Bankruptcy Filing Assistance

Phase 7 is labelled the liquidation bankruptcy phase. In a chapter 7 bankruptcy you can eliminate, eliminate or discharge most kinds of financial obligation. Examples of unprotected financial obligation that can be erased are credit report cards and medical costs. All sorts of people and companies-- people, couples, companies and partnerships can all file a Phase 7 insolvency if eligible.

Many Chapter 7 filers do not have much in the way of properties. Others have houses that do not have much equity or are in severe need of fixing.

The quantity paid and the duration of the plan depends on the debtor's property, median revenue and costs. Creditors are not allowed to go bankruptcy lawyer Tulsa after or keep any type of collection activities or claims throughout the case. If successful, these lenders will be eliminated or discharged. A Phase 13 bankruptcy is very effective since it supplies a system for borrowers to stop foreclosures and constable sales and stop repossessions and utility shutoffs while catching up on their protected financial debt.

Our Tulsa Bankruptcy Filing Assistance Statements

A Phase 13 situation might be advantageous because the borrower is allowed to obtain captured up on home mortgages or vehicle loan without the danger of repossession or foreclosure and is permitted to maintain both excluded and nonexempt building. The debtor's plan is a file describing to the personal bankruptcy court exactly how the borrower recommends to pay existing expenditures while repaying all the old financial debt balances.

It provides the borrower the possibility to either sell the home or come to be caught up on mortgage settlements that have actually fallen back. An individual submitting a Chapter 13 can propose a 60-month strategy to cure or come to be existing on home loan payments. If you reference fell behind on $60,000 worth of home loan repayments, you could recommend a strategy of $1,000 a month for 60 months to bring those mortgage payments present.

It provides the borrower the possibility to either sell the home or come to be caught up on mortgage settlements that have actually fallen back. An individual submitting a Chapter 13 can propose a 60-month strategy to cure or come to be existing on home loan payments. If you reference fell behind on $60,000 worth of home loan repayments, you could recommend a strategy of $1,000 a month for 60 months to bring those mortgage payments present.The Of Top-rated Bankruptcy Attorney Tulsa Ok

In some cases it is much better to avoid bankruptcy and work out with creditors out of court. New Jacket also has a different to personal bankruptcy for companies called an Project for the Benefit of Creditors and our law office will go over this option if it fits as a prospective strategy for your organization.

We have actually produced a tool that helps you choose what chapter your data is more than likely to be submitted under. Visit this site to make use of ScuraSmart and locate out a possible solution for your debt. Lots of people do not realize that there are numerous kinds of bankruptcy, such as Phase 7, Chapter 11 and Phase 13.

Right here at Scura, Wigfield, Heyer, Stevens & Cammarota, LLP we take care of all kinds of insolvency cases, so we are able to answer your bankruptcy inquiries and assist you make the very best decision for your case. Here is a short check out the debt alleviation options readily available:.

The Ultimate Guide To Tulsa Bankruptcy Filing Assistance

You can just submit for bankruptcy Before declaring for Chapter 7, at least one of these ought to be real: You have a whole lot of financial debt earnings and/or possessions a lender could take. You have a great deal of debt close to the homestead exception amount of in your home.

The homestead exception quantity is the higher of (a) $125,000; or (b) the county average list price of a single-family home in the coming before fiscal year. is the quantity of money you would keep after you marketed your home and paid off the mortgage and other liens. You can find the.

Report this page